Investment Strategy

by Larry Adam

Chief Investment Officer, Private Client Group

Weekly Headings

April 22, 2022

Key Takeaways

- Earnings may stabilize growing investor pessimism

- Reopening-oriented industries signal economic strength

- Supply chain disruptions appear to be more targeted

After two years of pandemic-related delays, the Boston Marathon was back in full force this week. The prestigious racing event is the world’s oldest annual marathon, with tens of thousands of runners hitting the pavement to complete the 26.2 mile run. One run that has yet to be completed is that of the current equity bull market, which is still setting a historic pace at this juncture (+100% since its March 23, 2020 inception). Between Russia’s invasion of Ukraine and the onset of Fed tightening, it’s proven to be a tough course as of late. But just as any runner needs disciplined training and proper nutrition to be successful, the equity market has relied upon the macroeconomic backdrop, attractive valuations, supportive corporate activity, and resilient earnings growth to stay on course.

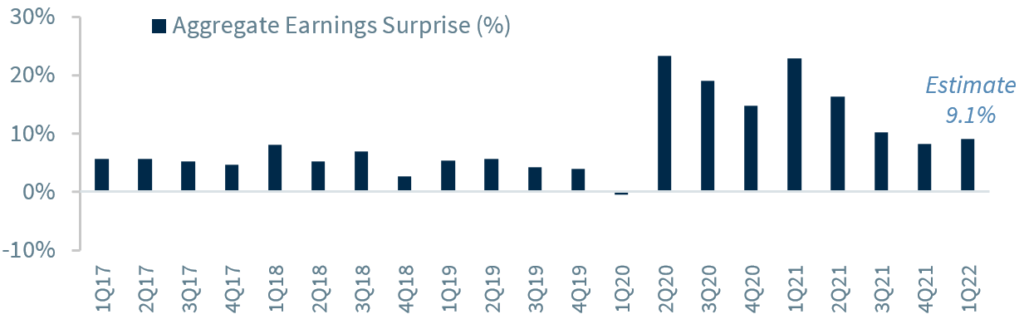

- Bottom Line – It’s A Marathon, Not A Sprint | Thus far, just over 100 companies, representing ~23% of the S&P 500’s market capitalization reported earnings.* The results are off to a quick start—81% of companies beat bottom line estimates (outpacing the previous 20-quarter average of 77%) and 69% of companies beat top line estimates (in line with the previous 20-quarter average of 69%).* But as any seasoned runner knows, an aggressive pace out of the gate may be difficult to maintain. However, if earnings continue to beat their estimates at the current pace of 9.1%, the current Q1 earnings growth estimate of 7% could extend into double digits for the fifth consecutive quarter. Earnings will gear up the next two weeks, with ~340 companies, representing +65% of the market capitalization of the S&P 500, set to report. Overall, we expect earnings season will be ‘good’ but not as great as we have seen the last few quarters. But that is to be expected after the torrid pace last year. More important, ‘good’ may be enough to stabilize the equity market and dispel some of the uber pessimism that has been building. Below are the themes to monitor as they are likely to impact whether or not the S&P 500 reaches our 2022 finish line target of 4,725.

- The Endurance Of The Consumer | Wall Street economists calling for a recession are attributing the expected downturn to a decline in consumer spending. However, we disagree on the premise that the ~$2.5 trillion in excess savings and the ongoing streak of job gains should continue to power spending. Companies such as Nike have noted that demand is “incredibly strong,” with spring retail sales off to a great start. Tesla echoed this sentiment, stating that the waitlists for certain vehicles demonstrate the company is “obviously not demand limited.” So while housing-related companies (e.g., Bed, Bath & Beyond and Restoration Hardware) are facing challenges, broader consumer spending trends remain robust.

Next Step: We’ll be monitoring the guidance of the retailers for further insights into shifting consumer preferences, such as increased spending on services (rather than goods), increased traffic in discount stores as inflation-strapped consumers search for bargains and whether or not shoppers are willing to forgo brand names for generic cost savings. - Reopening Still Has Miles To Go | The forward guidance from the reopening-oriented industries has provided investors with positive insights. Carnival Cruise Line boasted its best three weeks of bookings since resuming operations, and Delta saw business travel volumes reach the highest post-pandemic level. Many of the major banks also confirmed that travel and entertainment are indeed the top credit card spend categories. With the reopening picking up pace, some of the stay-at-home beneficiaries are facing difficulties. Netflix lost subscribers for the first time in a decade and Procter & Gamble acknowledged that demand for some products (e.g., surface cleaning, grooming devices) weakened from the pandemic-peak as away-from-home consumption increases. Cumulatively, these results should confirm our expectation of the shift from goods to services spending, and that there is underlying, consistent strength to this economy.

Next Step: Given that TSA screenings, hotel occupancies, and restaurant bookings are our favorite real-time activity metrics, the results of the airlines, hotels, and restaurants should confirm the healthiness of services spending. - A Change In Supply Chain Cadence | The Fed hopes to tame inflation through interest rate hikes, but the economy still needs supply chain disruptions to improve. CEO sentiment on this topic has turned more positive, with Fastenal stating that the “chaos” surrounding disruptions has eased, and Lennar viewing problems as a “supply chain opportunity.” The resiliency of US companies remains evident as Costco is expanding its warehouse network, FedEx is maximizing intermodal container usage and General Mills has reformulated some products 20x. Many firms acknowledged that Omicron prolonged inflation’s peak, but that broad disruptions are now more targeted and should improve progressively.

Next Step: We expect that inflation reached its peak in March, but any indication from logistics companies that pricing and transit times are improving will only further support this view. Recent gasoline price declines support this as well.

- The Endurance Of The Consumer | Wall Street economists calling for a recession are attributing the expected downturn to a decline in consumer spending. However, we disagree on the premise that the ~$2.5 trillion in excess savings and the ongoing streak of job gains should continue to power spending. Companies such as Nike have noted that demand is “incredibly strong,” with spring retail sales off to a great start. Tesla echoed this sentiment, stating that the waitlists for certain vehicles demonstrate the company is “obviously not demand limited.” So while housing-related companies (e.g., Bed, Bath & Beyond and Restoration Hardware) are facing challenges, broader consumer spending trends remain robust.

Click here to enlarge

View as PDF

** Source: Bloomberg.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.